TradeFutures Ltd

© Lorem ipsum dolor sit Nulla in mollit pariatur in, est ut dolor eu eiusmod lorem 2012

Implied Volatility

The Power of the Implied Volatility (IV) Charts

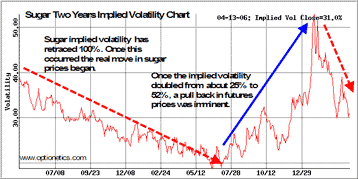

Look at the Implied Volatility Chart and the futures price. What does this tell us? SUGAR Sugar has been in a bull market since 2004 and continues to move higher. As worldwide demand for sugar continues, particularly with the pressure for alternative fuels such as ethanol, we can expect the previous highs to be tested over the next few years. Sugar falls within the opportunist implied volatility area of 19% to 20%. Sugar prices traded all the way down to 2½ cents per lb during 1985. As sugar prices started a new bull market, the 19 cents per lb (25 year high) resistance level has been taken out in 2006 (figure 2). Sugar prices are currently experiencing a pull back once the implied volatility increased to over 100% (from 25% to 52%) – figure 1 Figure 1: Sugar two years implied volatility chart. This helps explain the current bull run in

sugar.

Figure 1: Sugar two years implied volatility chart. This helps explain the current bull run in

sugar.

Figure 2: Sugar May 2006 daily futures prices. Following a 100% increase in implied volatility,

sugar prices have pulled back.

Figure 2: Sugar May 2006 daily futures prices. Following a 100% increase in implied volatility,

sugar prices have pulled back.

Repeatable Patterns

“If there is a repeatable pattern,

the market cannot be random. If it

is repeatable, it must be tradable.

All we have to do is build a trading

and money management plan to

take advantage of this type of

movement."

-- Keith Cotterill

“If there is a repeatable pattern,

the market cannot be random. If it

is repeatable, it must be tradable.

All we have to do is build a trading

and money management plan to

take advantage of this type of

movement."

-- Keith Cotterill

*Risk Disclosure: Trading security futures contract may not be suitable for all investors. You may lose a substantial amount of money in a very short period of time. The amount you may

lose is potentially unlimited and can exceed the amount you originally deposit with your broker. This is because futures’ trading is highly leveraged, with a relatively small amount of

money used to establish a position in assets that have a much greater value. If you are uncomfortable with this level of risk, you should not trade security futures contracts.

Copyright © All rights reserved : Trade Futures Ltd.

www.TradeFutures.co.uk

Commodity Trading Advisors & Management Consultants

Implied Volatility Article

I have written a comprehensive article

on this subject with numerous

examples and this has been published

in the July 2006 edition of the world

respected magazine "Technical Analysis

of Stocks & Commodities."

Click The Magazine Cover Above To

Read My Published Article.

I have written a comprehensive article

on this subject with numerous

examples and this has been published

in the July 2006 edition of the world

respected magazine "Technical Analysis

of Stocks & Commodities."

Click The Magazine Cover Above To

Read My Published Article.